How to raise a $33m Series A during an economic downturn

2023 will be a tough year for fundraising, and I can speak from experience.

In November 2022, we raised a $33m Series A from Radical Ventures and Temasek — and it was no walk in the park.

We had lots of investors drop out, as few were able to offer the ambitious revenue multiples and valuation ranges we were aiming for, and several were focusing on supporting struggling existing portfolio companies instead of adding new ones.

Fundraising is an essential part of your company’s growth, but it’s also a trap. Spend too long doing it, and the team’s morale begins to rot and the day-to-day business suffers. What began as a quest for new fortunes can soon sour into a bitter search for survival.

That’s why we wanted to share our six top tips to nail your fundraise.

Hopefully, these learnings will help you get your company funded quickly and energise your team, so you can put your head down and focus on building a great business — until you have to do it all again in two years…

1. Start with outreach: get introduced to 30-50 funds

Prepare a blurb to share with your existing investors (for them to make intros to investors they might be great for your next round) and for your own outreach. Remember, fundraising is like sales, and results come from succinct and persistent outreach attempts. Here’s an example of what that might look like coming from a VC:

Hey XYZ, I’ve been following V7, a ___ platform for ___. They’re raising a Series A and have a terrific product.

Here’s a few highlights:

- Founders are ex-founders of ____.

- ___ customers including ___, ___, and ___.

- _x revenue growth last year. _x growth this year

- __x organic visitor growth in 12 months

- __+ team size (_x since last year)

- __% retention rate for customers since 2020

- Raising $__m

Would you be interested in an intro to the founders?

Best wishes

You can easily adapt this email for your own cold outreach directly to investors.

After that:

- Create a dedicated inbox for the fundraise, something like [email protected] You’ll want to share this login with other team members to monitor and respond to emails quickly.

- Hopefully you’ll already have a list of lukewarm leads who contacted you in the past for an intro call. If not, search through your inbox for the words “capital” or “AUM” to fish out old conversations with VCs, and place them in your CRM (there’s a template for this CRM further down the article).

- Get warm intros to funds from your investors and friends. Start by having your existing investors list their potential warm intros on a collaborative spreadsheet to avoid overlap.

- Rank your leads by tier. Tier 1 funds are those you’d happily get a term sheet from. Tier 2+ are those you’d consider as backups. You’ll want to start your conversations with funds you don’t necessarily desire. Practice makes perfect and when the right conversation comes by you’ll want to be prepared.

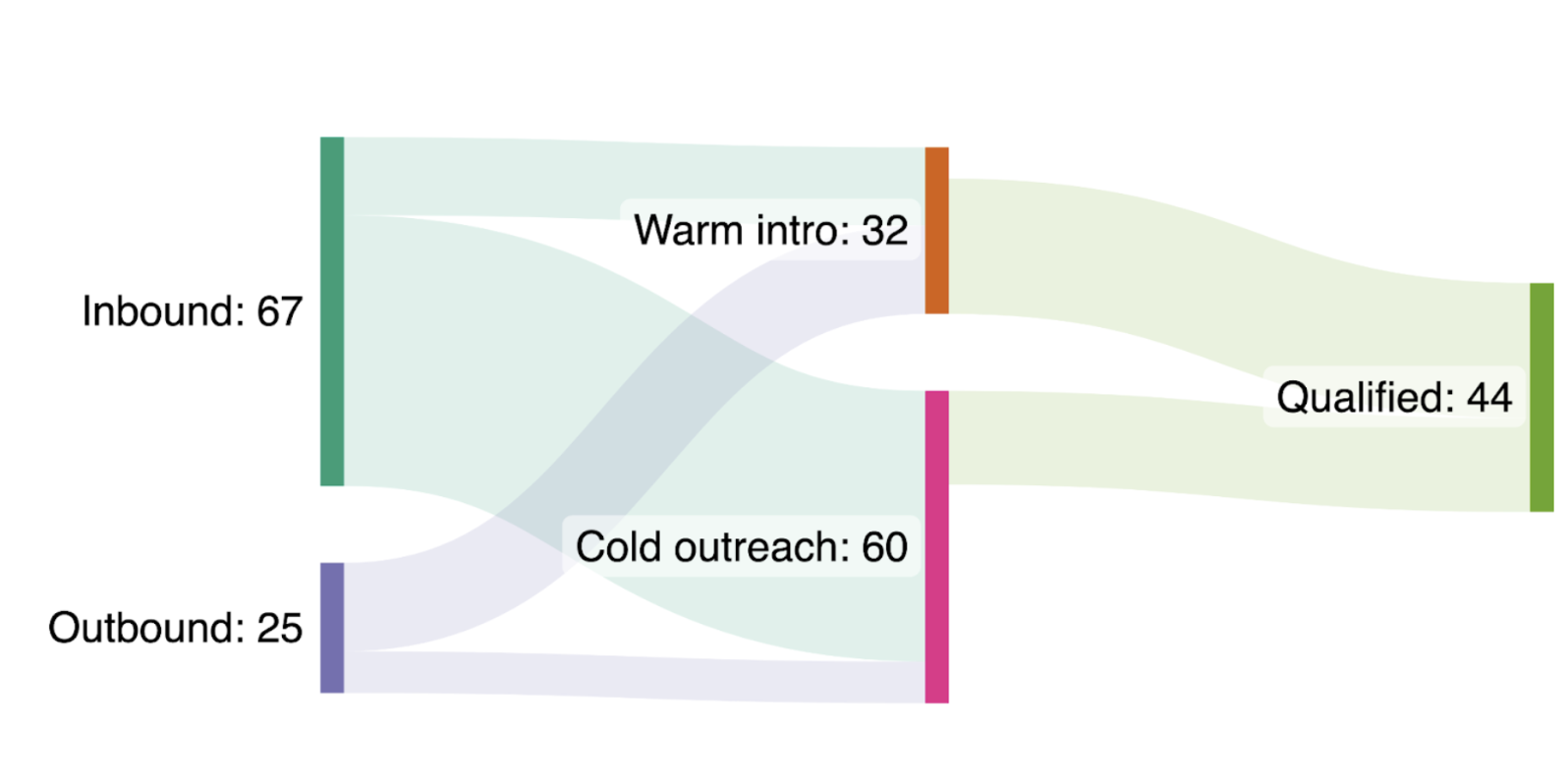

Here’s what our mix of inbound — funds that reached out to us — vs outbound — funds that we reached out to — looked like. Just like in sales, you need to qualify your leads to screen out duds.

Qualified funds are those which we vetted to be a potential fit based on capital to deploy (do they have the right cheque size for this round? Can they follow on in our Series B and C?), true interest and information about the field we operate in, a geographic match for our network, and their reputation with other founders. Look for genuine partners and don’t get caught up chasing dumb money.

Warm intros, even when they come inbound (that is, VCs asking our investors or angels for an intro to us) work far better on average; we netted 3x more qualified funds from warm rather than cold outreach. Your best source of warm intros are your existing investors. It doesn’t matter how cool your company is, getting another trusted human to introduce you immediately creates better rapport. Fundraising is largely about trust, and an intro helps you.

2. Build a deal team

Founders can fundraise alone at seed, but at Series A and beyond they’ll need a little help from their leadership team. We divided our roles in the following way:

- Email communication: CEO, head of sales and other key leaders should rotate the fundraising inbox to respond quickly and arrange follow-ups. If one of the cofounders is the CTO, you may want to shield them from most fundraising responsibilities so they may focus on growing the product. You want to respond within minutes, not hours or days.

- Sales due diligence: Your head of sales will spend an hour with promising investors to explain your sales strategy, forecasts and key numbers.

- Finances: Your finance or operations leader should get very familiar with your costs, revenue forecasts, margins and surface key figures in minutes.

- Customer References: Your head of customer success should prime your most interesting customers for reference calls with investors. Make it clear this may be up to a handful of calls, and promise them a thoughtful gift in return for the help. If your customers are startups make sure to let them know you’ll pass it forward.

3. Do your diligence on investors in early calls

An investor call isn’t just a time for them to do diligence on you. It’s also a time for you to learn more about their strategy and whether or not it would be the right fit if they were to offer you an investment.

- Could you guide me through the basics of the fund? Your average cheque size, vintage, do you follow on at Series B typically? Every VC has a rehearsed answer for this, but take notes on the numbers. The best out there will likely answer the remaining questions in this list as part of this intro so you can focus on your backgrounds and relationship.

- Have you been looking at our space for long? What are your thoughts on its winning direction? You’ll want to bring on your board someone who knows how to make you win. Often this is not just deploying capital, but championing the approach your company is taking to your category.

- What is your background and what led you into <firm name>? Build some rapport with the humans behind the fund, as they’re the ones who’ll join you as board directors or observers. You won’t always meet partners in your first meeting, however always make an effort to understand the calibre of humans these people bring into their ranks. VC firms don’t have large numbers of staff, so the quality of people within the firm is also indicative of the qualify of talent they will introduce to you once they invest.

- Are there any portfolio companies adjacent to us that could act as good references, or that have had similar growth challenges to the ones we’re likely to face? This is a question best suited for a follow-up meeting. You’ll want to make sure your investors know how to support the type of company you are, for example, an ecommerce company, or SaaS for developers.

4. Use Pitch for your deck (and steal our template)

Tools are almost as important as process. Two years ago, during our seed round, we relied on DocSend to send material to investors. This time, we used Notion and Pitch, which allowed us to embed videos, Looms and graphs that behave like native elements, as well as custom URLs that we can track. This took our Series A fundraising to a whole new level.

5. Get your data room in order (and use our template)

Your data room reveals to investors how clean and measured the inner workings of your business really are. An exhaustive data room reduces back-and-forth and accelerates deal flow. Your biggest enemy is clarification calls that happen when there is a missing statistic or poorly illustrated graph.

Our data room received lots of praise at Series A, so we’ve made the template available. Though it’s heavily redacted, it gives you an idea of the level of detail you can go into without doing much ad-hoc work. Have a look and if you aren’t tracking some of the info within it, make sure you start now.

Standout elements that investors really enjoyed were the Gong call recording snippets we included that showed a genuine reaction to the product by users, an in-depth competitive analysis and extensive use of graphs.

None of this material was produced from scratch for the data room — it lives inside our sales enablement, customer success training and other pieces of the business.

You can look through and create a copy of your template here: Series A Data Room (Template)

6. Manage investors like a sales pipeline, and use a CRM

Fundraising is sales. The only difference is you have only one item left of the product you’re selling, so you’ll want to focus on coordinating your pipeline stages.

Put your account executive hat on and get organised. Start by using a CRM that your leadership team can access. We went for a simple Notion board to keep things mobile-friendly.

You can access our CRM template here: Series A Investor CRM Template – Used in V7’s $33m Series A (2022)

One thing we found useful was to take a screenshot of the Zoom window for each call to remember everyone’s face. Below it, we would write notes on the backgrounds of the folks in the call, details of the fund and what their thoughts on our space were.

The CEO would take the first and second calls, and then usually pass the baton to the head of sales. Calls with other leadership figures including the cofounder and CTO would usually happen after the third call to avoid distractions.

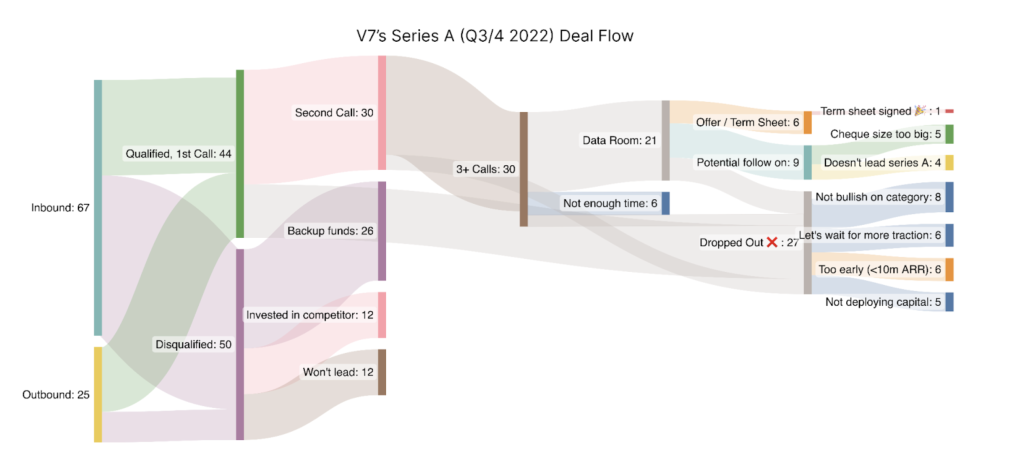

Here’s a Sankey diagram of how we did this for our Series A:

Note: Some of the drop-out reasons may be polite rejections, or the real reason could have been that our product just didn’t impress the partner or they didn’t like the founders.

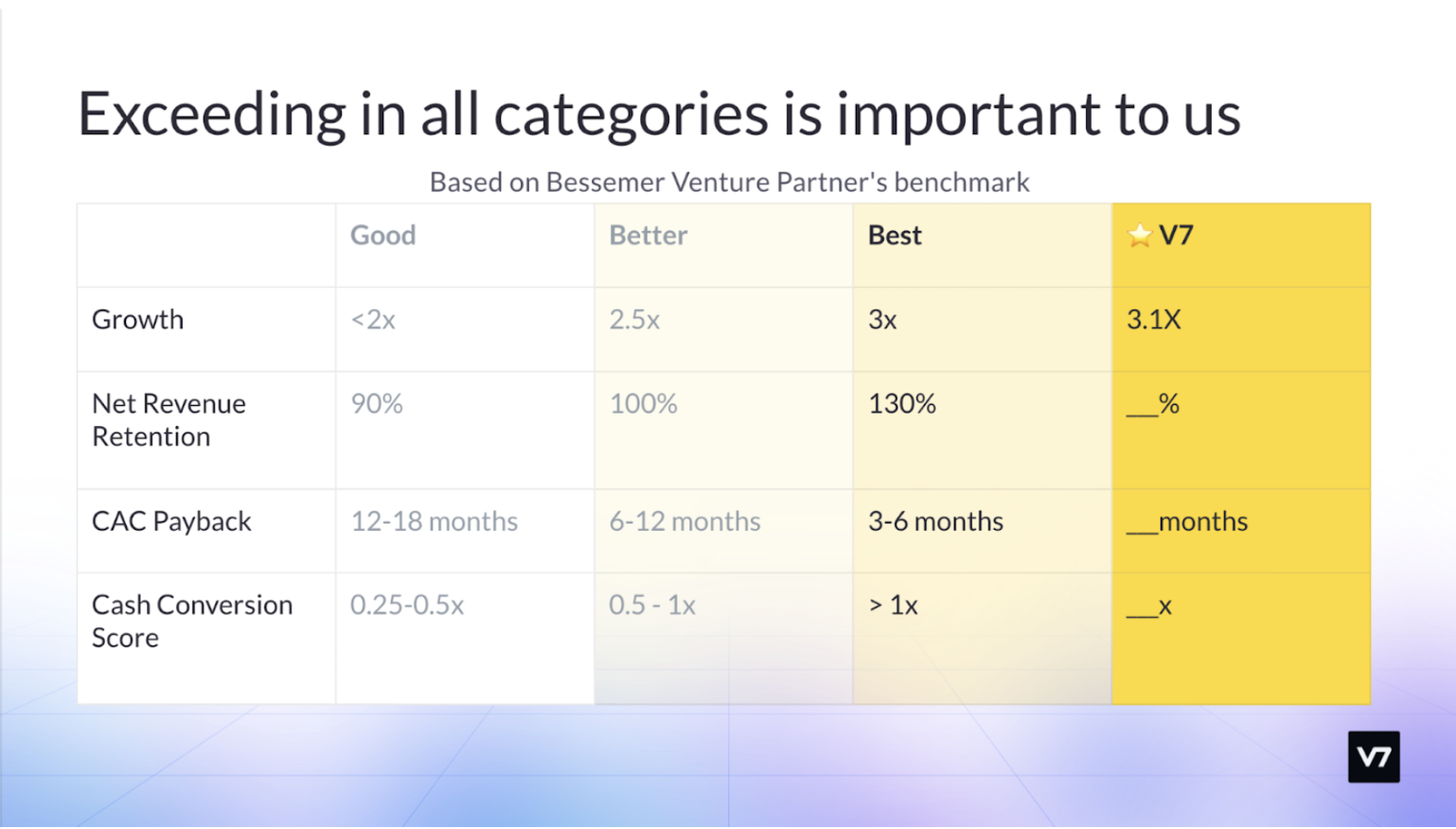

We used US VC Bessemer’s startup metric benchmarks to give us an idea of how VCs would judge our performance against our peers. We fell in the 95th percentile according to these metrics and had a 5-8% success rate in securing a term sheet. That tells us a few things about fundraising — and just how hard it is right now.

First, metrics tracked in 2021 and early 2022 no longer matter as much. Cash conversion score and net revenue retention (NRR) are now observed more closely than the growth rate.

Second, with less money around, competition matters. A common response to our pitch was: “Your competitors are very well capitalised, how will you win in the same category against companies who raised 5-20x more than you?”

Third, relationships speak louder than numbers: most of the funds that made it to the end knew me and Simon, our CTO, beforehand and followed our journey.

7. You’ll only sign one term sheet, so create FOMO

Part of your leverage will depend on how many other buyers are evaluating your startup. Don’t fall into the trap of trying to align your deals as different funds move at different speeds. Instead, move as fast as possible in the early stages of the pipeline and get funds to put effort in the process. It’s easier to get funds to move faster if one player is ahead, and harder to pass when there’s momentum and excitement at the early stage. You’ll have more time to evaluate offers towards the end of the journey, than to book follow-ups towards the beginning.

In the suboptimal economic times we’re in, it’s also important you carry on the discussion with funds that will greatly help you at Series B and beyond. You most likely won’t get the revenue multiples and the same favourable terms you could have obtained a year ago, but don’t mull over that too much: just get the damn money. Pick a fund that is focused on how to win your category rather than your ability to stay lean.

It’s a tough time for startups compared to two years ago, yet we’re still in an era of unprecedented access to capital, and access to people who can deploy it. Start gathering your metrics, get out there and tell your story!

Alberto Rizzoli is cofounder and CEO of V7, and Bill Leaver is product manager at V7.