Ayo Akinola: Tips to Help SMEs Manage Cost to Cope with Inflation

The National Bureau of Statistics (NBS) Inflation Report for July shows that the annual inflation rate has risen to 19.6% – the highest in 17 years. Many business owners do not read these inflation reports, but they experience its impact nonetheless.

Inflation is the measure of the rate of rising prices of goods and services in an economy. That is the rate at which things become more expensive. Basically, what you could buy in the market with $10 last year, cannot buy the same this year. And as a business, you should pay attention to this because it affects your gross margin (the amount of profit you make before removing expenses). According to MoneyCentral, roughly 70% of the revenue made by Nigerian businesses is spent balancing out direct costs.

We are an economy that is still recovering from the impact of the COVID-19 pandemic, so it is important for Small and Medium-scale Enterprises (SMEs) to manage inflation. Here are 5 practical ways you can keep your margins by optimising your costs:

Do your best to retain workers

Hiring good staff is not only expensive, but it could also put a strain on the business. Businesses often bear the high costs to replace workers during inflation. Getting, training and adjusting them to your work environment introduces added costs which could affect your bottom line. You should look to replace staff only when necessary as the process could affect your business productivity. Do what it takes to retain your workers.

Transfer extra costs to the customer

This is business! Before you judge me, hear me out. A great way to manage inflation is to balance out costs by finding ways to transfer them to the customer. If your product or service is inelastic (i.e., customers buy no matter the price) then you can increase prices to reflect inflation rates. Otherwise, you can add a few extra products or services to justify price increases.

Evaluate your costs and redesign your processes

The first step to managing money effectively is to evaluate and supervise your spending. This goes for both businesses and individuals. You need to know where the revenue comes from and how it is spent. This is the foundation for all other money-related actions. Inflation calls for you to rethink how you run your business. So take a look at how it affects the way you spend money, what you spend, and how it connects with the operation of your business. Remove unnecessary tasks, merge similar activities, and automate repetitive tasks to achieve more efficiency.

Improve your Cash Flow

The first thing to note is that during inflation, the value of money drops gradually. During this time, you need to get your cash quickly. Credit sales (buying on credit) are not recommended during this time, however, you should delay paying bills as much without acquiring a late fee. The extra money you now have access to can be invested in profitable short-term securities (e.g. money market) to get you extra income for expenses and business growth.

Manage Shocks from the Supply Chain

If you have vendors or suppliers, it is important to reevaluate your supply agreements to find the best fit for operations during inflation. Try longer-term contracts. This way you could lock in contracts for a long time to avoid paying more tomorrow.

Also, avoid exclusive deals, that is, working with just one vendor or supplier. This way you won’t be at the mercy of such vendor during a price increase. Vendors always compete, so find new suppliers that will give you discounts, affordable prices and more. This gives you more value for your money. No matter what, ensure no crisis from your supplier affects your business.

***

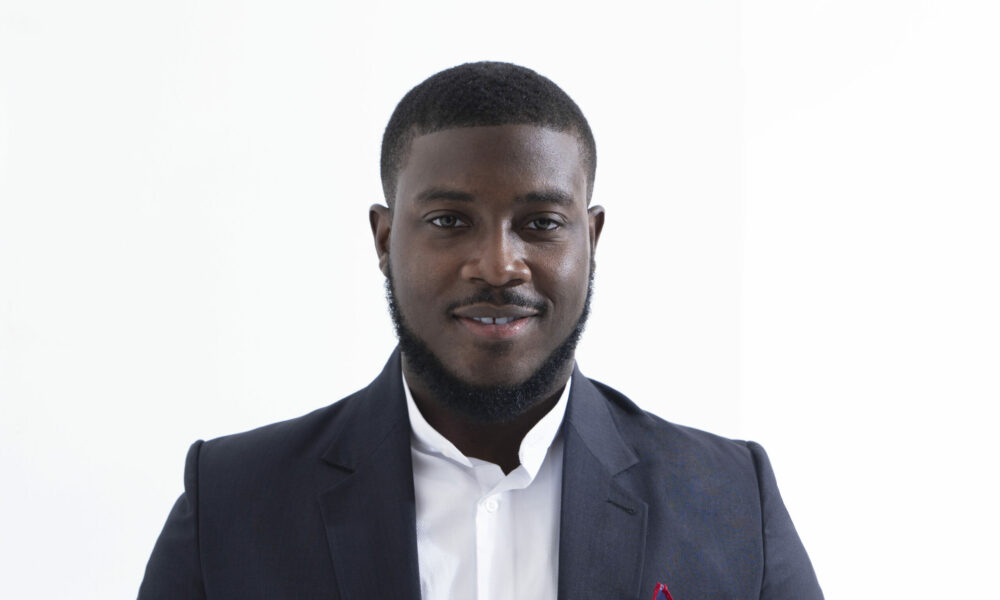

Ayo Akinola is a Nigerian tech entrepreneur, public speaker and motivational life coach. He is an alumnus of the prestigious Covenant University, where he obtained a computer science degree. Ayo has a strong forte in business development, relationship management, strategic planning, and sales. In the tech space, Ayo has built a reputation as one of the brains behind fin-tech products like PiggyVest, Patronize, and the new PocketApp, which doubles as the current headline sponsor for the Big Brother Naija season 7. Reach Ayo via social media – @AyAkinola on all social platforms.